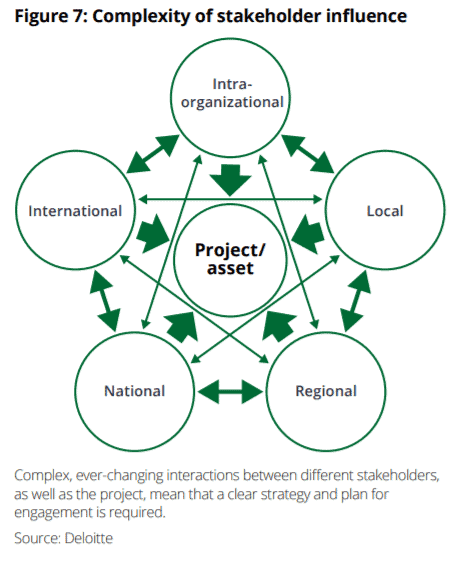

In the mining industry, stakeholders are of multiple types. Internally, there is the workforce – i.e. a critical driver to maintaining productivity. Externally, mining companies must contend with their shareholders/investors, governments, local populations and a plethora of other groups that can be directly or indirectly affected by that mining company’s operations.

Understandably, being amenable to your stakeholders’ interests is critical for many reasons, not least the fact that government permits are essential for ore exploration purposes or that financial investors are necessary to fund capital modernization or expansion projects.

Thus, securing stakeholder buy-in is essential, and information plays a pivotal role in achieving the necessary internal and external support. Generally, stakeholders will request insights about your mining operations – i.e. processes, equipment, challenges and means to boost profit.

Understanding Mining Company Stakeholders

The following will offer some understanding of a typical mining company’s leading stakeholders.

Shareholders

Your investors and financial shareholders are among your principal stakeholders. Shareholders are primarily focused on how to maximize their return-on-investment (ROI) and will need insight in how you are controlling your mining operations’ costs and working to boost profit.

Governments

Government stakeholders are important because they are the gatekeepers to securing permits for ore exploration and recovery. However, while some concerns are consistent across different countries – e.g. local employment – others can very, e.g. environmental policies.

As per KPMG,“regulatory approval has become a major issue, and more than one high-profile project has failed to get off the ground due to delayed or denied permits, in some cases costing the owners hundreds of millions of dollars.”

Though a different group of stakeholders, how you are managing regulatory bodies could be of concern to your financial shareholders, especially if these shareholders are committed to new projects, expansion and/or mergers that could fail due weak regulatory relations.

Public

Just as your regulatory environment could affect your shareholders, buy-in (or lack thereof) from the public could affect your ability to secure permits. These stakeholders can comprise of many interest groups – i.e. labour, environmental groups, political parties, industry groups and others.

However, when it comes to financing your current and future operations, your shareholders are of principle concern. These individuals are interested in a range of information, be it the output of your current mining operations – i.e. expenditure on equipment, labour and logistics – to their return-on-investment (ROI) opportunities.

Essential Insights for Mining Stakeholders

To manage expectations and plan in your mine’s best long-term interests, you must provide your stakeholders with a thorough understanding of the mine’s operational capabilities. The following are some of the essential insights your financial or investor stakeholders need to know.

Bottlenecks

You must identify and outline how your mine is limited. In other words, identify the system-level bottlenecks that prevent the mine from producing at its output potential. These bottlenecks can take the form of existing equipment, processes and external factors.

Equipment

Equipment that can cause system-level bottlenecks could include systems that are performing at under capacity. This could be a result of insufficient energy or fuel, poor training or inability to keep up with prior inputs (thus causing delays across the whole chain).

It is important to identify the correct system-level bottleneck, not a short-term constraint. Solving the latter will not deal with the underlying problem throttling your output.

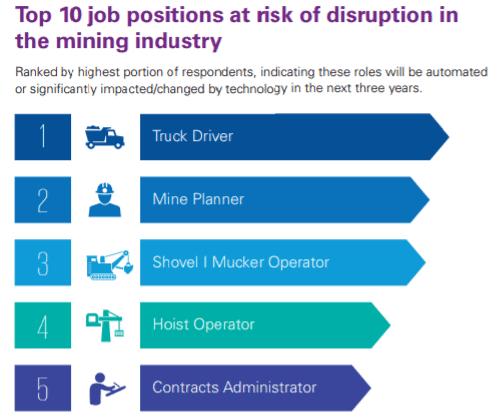

Processes

Obsolete and/or misapplied processes at your mine can also be causing bottlenecks. It could be in place in one of many levels, e.g. from the recovery process in the mine (e.g. shovels) to the back-end or administrative processes of your mining company.

Your shareholders may ask how changes to these processes can affect your mining operations.

Top 10 Mining Jobs at Risk of Disruption

To gain this insight you will need a strong understanding of how changing your processes can affect the overall system. Being able to answer how process changes could affect output need to be in the insights you offer to your stakeholders.

Win investor confidence with undeniable operational insights

External Factors

Certain factors, such as regulatory approval and permits, could be bottlenecks as well. But this would generally be at the strategic level more so than your mining operations.

Variability

Variability in your mine’s performance could be emanating from intrinsic or man-made factors.

In terms of intrinsic factors, the health of your mineral or ore deposit and/or the quality of the ore can affect your bottom-line (e.g. you could fail to secure buyers).

Man-made factors such as your mining or recovery processes could also be causing variability in your mining operations. To identify if this is the case (or to assuage concerns and argue that it is not), you will need strong operational insights through industry expertise and simulation.

You must answer which areas have the most variability and identify options for resolving them.

Understanding Changes

In proposing solutions to bottlenecks or performance variability, you will need to explain to your stakeholders how changes in any part of mining system can affect the whole system.

Investors will want to know how these changes will support the bottom line, so advocating for a higher output for its own sake is not answer you are providing – rather, you must demonstrate a commitment to increasing profitability.

Next Steps to Building Strong Insights

Ultimately, your stakeholders will look to have you explain your mining operations’ problems and potential solutions in considerable depth. However, you must also address immediate concerns, such as increasing profit by controlling cost.

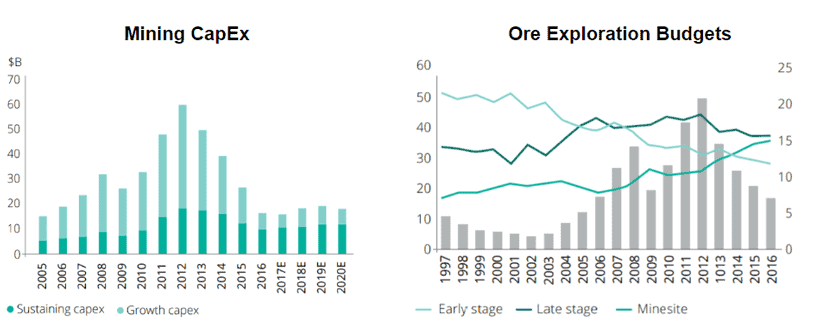

Despite a recent rebound in mineral commodities, the environment for pushing CapEx and big expansion efforts may not be very amenable. Thus, you will need to build a thorough insight of your existing mining operations as well as become an expert on how to optimize resources and increase profitability within your existing system.

This requires a combination of both mining industry experience along with a cadre of business, engineering and computer science experts to build a holistic and detailed picture of your mining operations. Your stakeholders are coming from different walks, so it stands that your ability to answer their contentions show expertise in how different factors affect the mine and them.

Leveraging Fortune 500 experience, MOSIMTEC combines deep-rooted industry expertise with first-in-class competency in modeling, simulation and engineering consulting to provide mining executives and leadership teams with in-depth insights into their mining operations.

From constraints to opportunities for maximizing immediate revenue potential, MOSIMTEC will equip you to make decisions that will see strong return-on-investment. Contact us today.