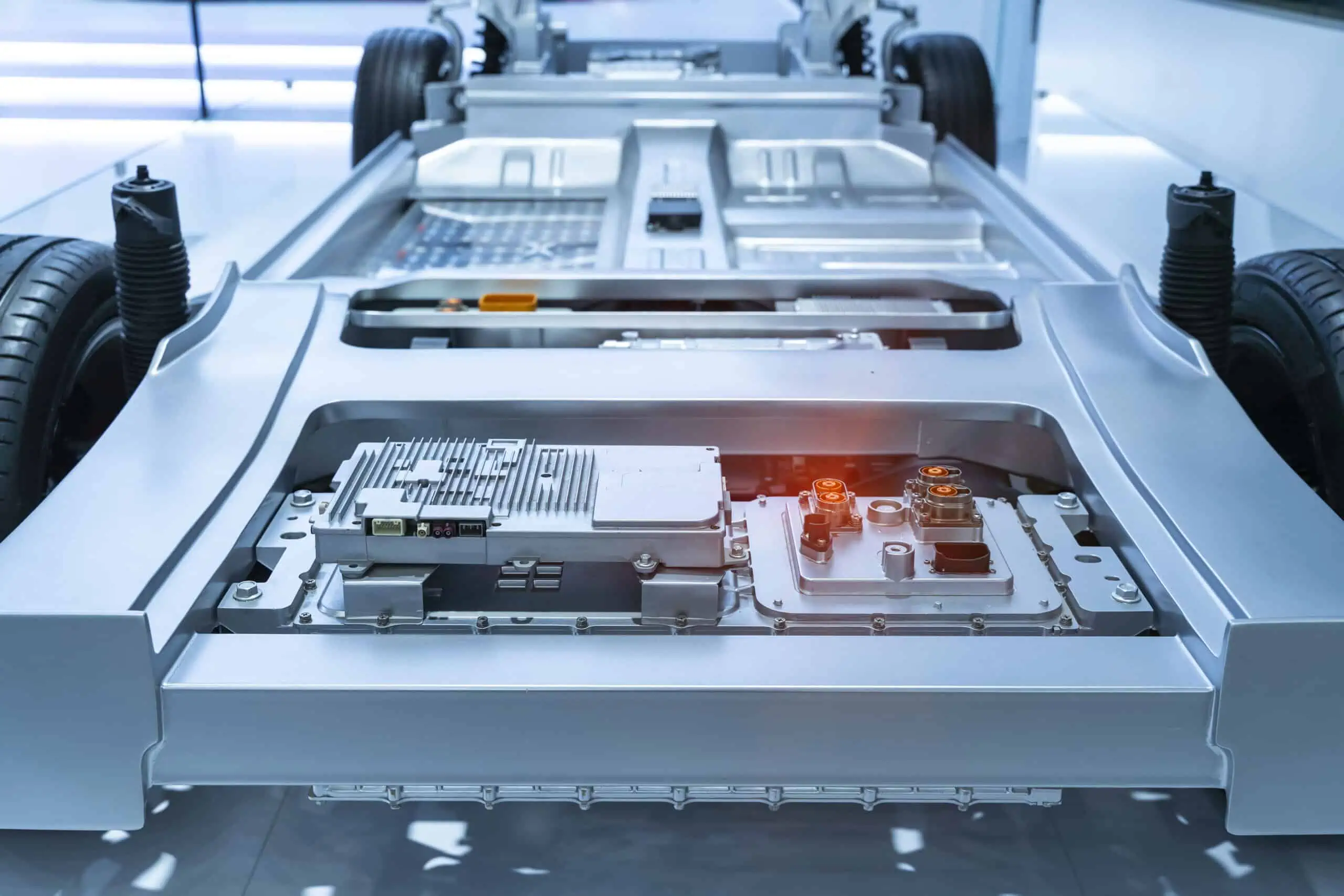

The auto industry’s shift to electric vehicles (EVs) has triggered a scramble to lock in supplies of lithium, nickel, graphite and other materials core to battery making, much of which are currently mined and processed outside the U.S. in places such as China and Australia. The potential of an eventual EV battery shortage is pushing car companies to get more directly involved in the mining business.

GM recently agreed to invest in a joint-development project with Vancouver-based mining company Lithium Americas. The deal gives GM exclusive rights to lithium extracted from a remote desert site in Nevada called Thacker Pass, one of the largest known lithium sources in the U.S. Ford Motor said it would buy an equity stake in an Indonesian nickel mine. Stellantis said it would invest $155 Million in a copper mine in Argentina. In 2022, Tesla contracted directly with mining companies or refiners for more than 95% of the lithium hydroxide and 55% of the cobalt it needed for batteries.

The minerals deficit is a big challenge for automakers. Numerous mines need to be developed and cost overruns are a constant threat. MOSIMTEC can help. We specialize in deploying digital twin technology for mining companies and have done dozens of mining projects, including all aspects of the value chain (mining, processing, supply chain and more) across mine types, geographies and minerals/products over 15 years. Our industrial engineers and data scientists specialize in advanced simulation, digital twin and analytics tools to help mining companies improve performance and meet budgets. MOSIMTEC can help you future-proof your mining operations.

#modelingandsimulation #digitaltwins #futureproofyourbusiness #mining simulation

Read more: https://www.wsj.com/articles/the-new-ev-gold-rush-automakers-scramble-to-get-into-mining-ebda14eb