The inherent complexity surrounding mining projects makes these initiatives both very valuable and incredibly risky. In fact, the risk emerges right from the onset, i.e. simply proposing an exploration project could collapse following a commitment of private investment.

In 2013, a provincial government in Pakistan refused to provide Tethyan Copper Co. its mining license for the ‘Reko Diq’ deposit, causing Tethyan a loss of $400 million in investment. As one can imagine, this was a severe loss for investors who, in turn, sought $11.43 billion in damages.

Thus, mining projects are liable to fail before getting off the ground, much less after mining is in full-effect (and when questions of optimizing costs arise). The following are the top five reasons why certain mining projects never take-off.

1. Insufficient Human Capital to Sustain Mining Project Life Cycle

According to Accenture, insufficient human capital is one of the top reasons why mining projects fail to get off the ground. Basically, mines may not secure the right or sufficient labor to start-up mines, especially in deep, remote or generally less accessible mineral deposits.

In fact, Ernst & Young (EY) found that in many cases, there is simply insufficient human capital to start-up and/or sustain large-scale operations. For example, the Australian mining industry is expected to require as many as 86,000 additional workers by 2020 to sustain its output.

However, today’s mining operations need more than simply numbers, they also need expertise to handle increasingly operations. Mines are increasingly becoming deeper, which in turn will require human capital in the relevant engineering, geology and mechanical sciences.

The operating area of the proposed mine also has its human capital constraints. For example, in some countries you might not have much of a pool from which you can secure skilled experts. In other cases, a country’s inherent security risks could deter foreign engineers and technicians.

2. Unable to Secure Mining Project Investors & Fiscal Support

The lack of financing mechanisms or fiscal resources to sustain capital expenditure (CapEx) for new mining projects is among the leading reasons why mining projects fail to materialize. One must acknowledge that the investor environment regarding mining is conservative.

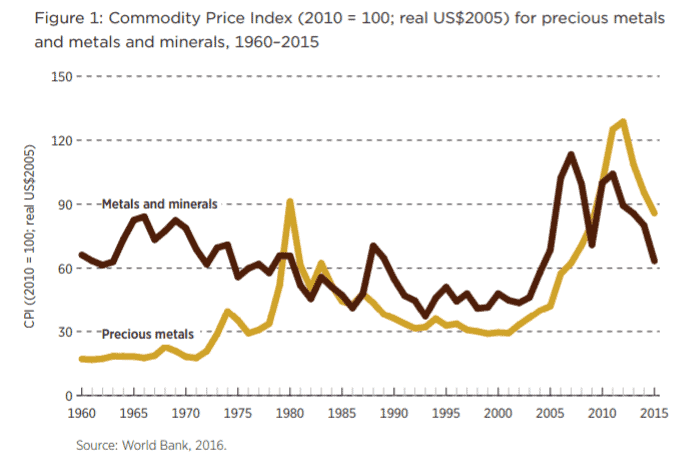

Since 2012, global commodity pricing had sharply declined from its peak (although it has begun to recover in 2017). This macroeconomic issue affects mining because the value the market is now placing on your ore is less than what it had been in the preceding years (see graph below).

Commodity Price Index (2010=100; real US$2005)

for Precious Metals, Metals and Minerals

Thus, it is to be expected that investors are hesitant to commit to major CapEx-intensive work. Mining involves significant upfront expenditure, especially Property, Plant and Equipment, which collectively form a high proportion of the cost as well as your ongoing overhead expenditure.

Current mining realities, such as the fact that 75% of new base metal discoveries are made in geological depths of more than 300 m (Deloitte), will have only added to CapEx outlays. Thus, investors have shifted their focus to optimizing existing mines instead of expanding operations.

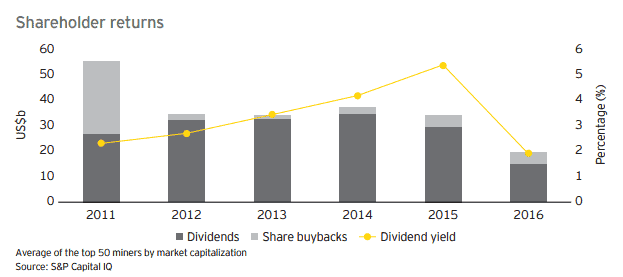

Shareholder Returns in the Mining Industry

As EY explains, shareholders and investors in the mining industry will generally favour dividends over growth, especially in the current climate of commodity prices being under pressure. Thus, a new mining project will be viewed with significantly more scrutiny than in earlier years.

Gain Shareholder Support by Using Objective Data

3. Declining Resource and Ore Body Quality

Mining projects can also collapse due to a mischaracterization or understanding of the area’s orebody. For example, insufficient research could lead a company to invest in deposits that do not offer sufficient orebody quality for the industry.

Likewise, the mineral resources available to the mining industry are of lesser quality today than in the past. According to Deloitte, the weighted average head grade for copper, nickel and zinc between 2001 and 2012 had dropped 30%, 40% and 10%, respectively.

But with lower quality orebodies, the cost of mining (per ounce or ton) rise, thus returning us to the issue of CapEx and assuaging investor fears. There is a risk that proposing a mining project without adequate (and objective) information about the orebody will basically be a non-starter.

4. Insufficient Energy, Logistics and Infrastructure

Besides capital intensive machinery, mining is also intensive on other resources, namely energy, logistics and infrastructure. In some regions, there is the risk that accessing those resources are either cost-prohibitive, or simply not possible due to the lack of requisite infrastructure.

In Chile, for example, copper mining, smelting and refining consumes one-third of the country’s electricity. With such a limited energy base, there is a significant risk (especially for investors) of incurring a system-level bottleneck, inefficiency or actual losses should energy access be hit by an external factor, e.g. a natural disaster damaging powerplants.

Likewise, an essential component to productive mining operations is transporting recovered ore from the mine to the market. A poorly conducted assessment of the operating area’s transport or logistics infrastructure (e.g. not accounting for poor or limited roads, inaccessible shipping ports and/or inherent political instability) could squash a mining proposal or burn investment money.

5. Unable to Gain Favourable Regulatory Terms

Returning to the example of the Balochi government not releasing an exploration permit to the mining company Teythan, it is evident that regulatory issues can squash a mining project. In this case, Balochistan’s refusal had basically made $400 million in prior investment moot, so the risk is certainly real and the cost of it occurring is hefty.

In fact, EY had identified regulatory risk as one of nine business risks to new and current mining operations. These risks manifest in various ways, but typically include state driven efforts to gain equity in mining projects, demand local socio-economic offsets or simply be weighed down by a range of bureaucratic red-tape that can slow progress and/or escalate costs.

Success Begins with an Objective Mining Project Evaluation

In many cases of failing mining projects (especially at the proposal or design stage), the central problem emanates from incomplete assessments, lack of information or not charting out enough clarity for securing investor confidence. Likewise, even if investors come through, an insufficient mining project evaluation could have costly consequences.

The first step for mining industry executives should be to build strong insights, but doing so will require leveraging experts with mining industry experience and first-in-class tools.

Not only will these experts draw on previous mining projects to offer you with objective, detailed and goal-oriented insights, but they will leverage mining optimization tools – such as modeling and simulation – as a means of equipping you with answers for financial and government stakeholders.

MOSIMTEC brings a deep cadre of experienced industry experts and world-class modeling and simulation tools to provide mining executives with actionable insights.

In our experience backing Fortune 500-level clients, including those in the mining industry, we have generated ROIs of at least 10X through cost savings and revenue increases. Contact us today to see how you can identify strong revenue sources for your mining company.