The world’s top aerospace and defense (A&D) OEMs — Boeing and Airbus — are driving several major new aerospace trends in 2019.

And between these two companies, there’s one major driving force for the adoption of new technologies and processes. After spending the past 2 decades aggressively outsourcing workshare to external manufacturing partners, both Boeing and Airbus are starting to move their production back in-house.

A significant reason for the shift is the need to reduce costs and increase production output to fulfil their commercial aircraft order backlogs — i.e., up to 38,000 units over 20 years (Deloitte).

In turn, this shift is triggering a series of changes across the global aerospace industry. Be it the growth of Boeing and Airbus’ manufacturing footprint, or the adoption of new technology among other A&D companies, the aviation industry will look very different in the near future.

Cut Manufacturing Costs & Time-to-Market

by Eliminating Bottlenecks

1. Moving Away From Outsourcing the Supply Chain

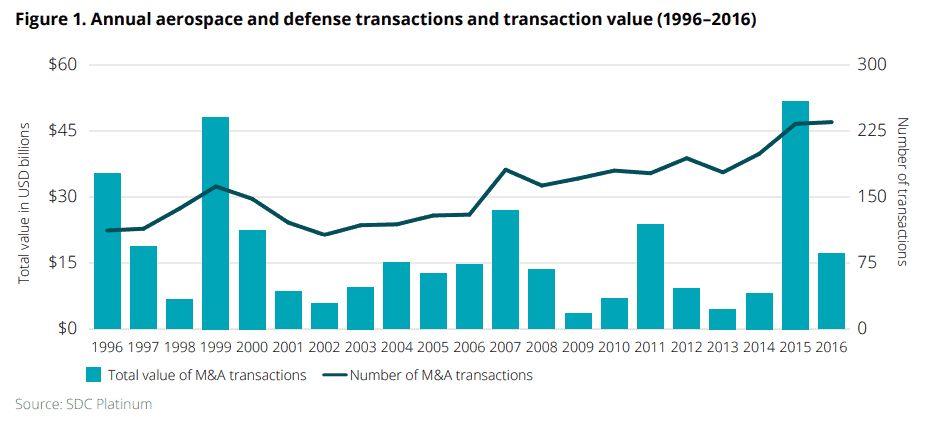

Through the 1990s and 2000s, the two A&D giants (but Boeing in particular) had sought to slash costs and increase production by outsourcing. In addition to giving contracts to small and medium manufacturers, Boeing also used workshare offsets to enter new markets. So if an airline in India bought Boeing 777s, Boeing would subcontract work to Indian companies.

Boeing and Airbus built a global supply chain doing just that.

However, as Boeing and Airbus ramp-up production rates, these suppliers may have trouble meeting the OEMs’ needs.

To control costs and increase production rates, both Boeing and Airbus are now moving back towards in-housing their production work (Aviation International News).

Vertical Integration

Thus far, their vertical integration efforts have involved setting-up both new internal units and buy-outs. For example, Boeing bought aircraft interior supplier EnCore Group in June 2019.

The goal for Boeing and Airbus is to take on more of the production work for each aircraft so that they can control output and boost margins. They can do the latter by using their massive economies-of-scale (38,000 aircraft over 20 years) to lower total manufacturing costs.

Horizontal Integration

Boeing and Airbus can further their economies-of-scale with horizontal integration. In this case, they can each use their composites research to manufacture aerostructures for civilian as well as military and government aircraft.

In any case, the push for in-house production will take workshare away from Boeing and Airbus’ upstream suppliers. These smaller manufacturers rely on the large OEMs, so this shift will push these companies to look at ways to cut costs and boost output.

2. Moving Into Additive Manufacturing

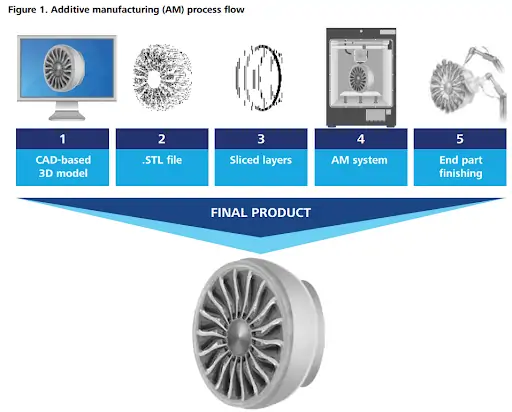

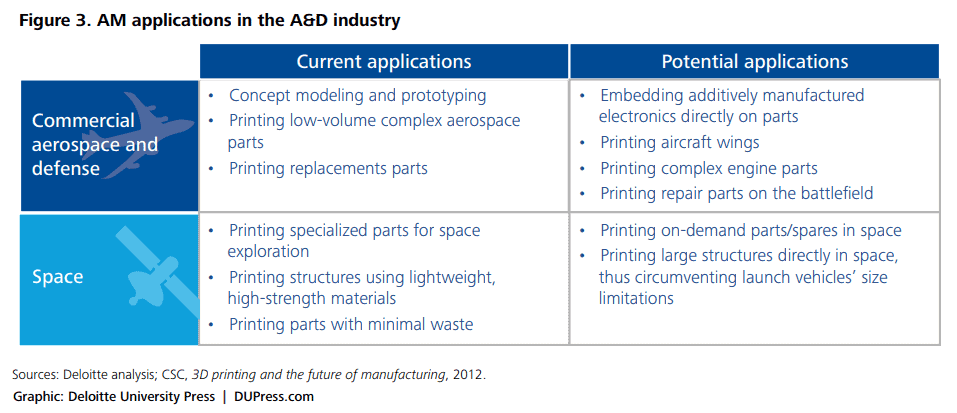

One solution available to upstream suppliers is additive manufacturing (AM) through the use of 3D printing technology

AM may be finally catching on in other sectors, but interestingly, the A&D industry was an early adopter (since at least 1983). Today, A&D firms contribute 10.2% of AM’s $2.2 billion annual revenue (Deloitte).

A key advantage of AM is that allows manufacturers to produce parts with very complex internal structures, like cavities. These parts are meant to reduce the aircraft’s weight while also improving its performance. But there’s a risk of compromising the aircraft’s integrity and durability; AM can eliminate the risk by producing complex parts, but without compromising safety or the lifespan.

Generate More Revenue From Your Manufacturing. See How Below:

- 7 Key Advantages of Simulation for Business

- 4 Types of Simulation Models to Leverage in Your Business

Traditionally, A&D manufacturers have used AM to prototype and test component designs, and to an extent, manufacture specific parts. However, opportunities exist to expand AM to take on aerostructures (e.g., wings, fuselages, stabilizers, etc.). Studies are already underway to push AM for the manufacturing of unmanned aerial vehicles (UAV) (Deloitte).

By using AM to produce aircraft parts, manufacturers can cut time-to-market by 64% and bring the cost of producing those parts down by 50% (Deloitte). In other words, upstream contractors could meet their OEM partners’ aggressive timelines and cost-cutting requirements.

However, AM technology is also available to A&D OEMs, so they can incorporate those as part of their in-sourcing efforts. In turn, the OEMs can generate the benefits directly.

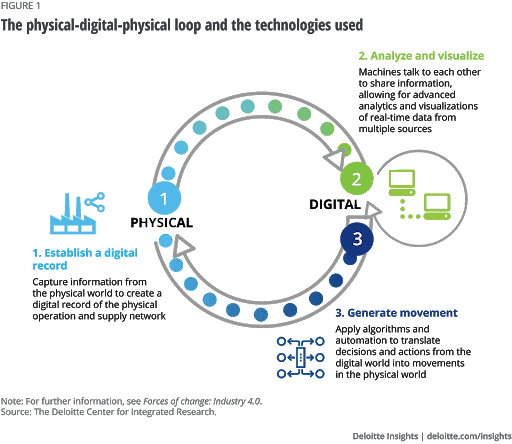

3. Embracing Industry 4.0 to Cut Costs and Increase Production

Industry 4.0 will be a common reality for OEMs and upstream manufacturers alike. So even if Airbus and Boeing in-source their supply chains, they will maintain hundreds of manufacturing units across the world. If there’s no consolidation, they’ll still work with hundreds of partners.

In either case, there’s an opportunity to achieve new cost-savings and time-to-market gains by extracting and analyzing data from all of those units. Under Industry 4.0, A&D companies could use those insights to make decisions about their manufacturing processes.

There are multiple methods of implementing Industry 4.0, but in the defense and commercial aerospace sectors, Industry 4.0 can involve the following:

- Additive Manufacturing

Using 3D printers to rapidly prototype parts and, potentially manufacture aerostructures.

- Advanced Analytics

Studying data about an aircraft or manufacturing unit’s health to schedule maintenance and downtime outside of high-usage periods (when the company needs them most).

- Advanced Robotics & Cognitive Automation

Using robotics for manufacturing aircraft parts and aerostructures with fewer errors while also cutting time-to-market.

- Artificial Intelligence (AI)

Using data from robotics, aircraft, and other sources to predict optimal maintenance and downtime schedules.

The Physical-to-Digital-to-Physical Loop is a Key Part of Industry 4.0

-

- Blockchain

Using distributed ledger technology (DLT) to achieve more transparency between supply chain partners, reduce errors, and implement just-in-time logistics. - Digital Reality (AR/VR/Mixed Reality)

Using smart glasses to deliver CKD/SKD kit instructions instead of paper documentation to accelerate assembly output.

- Blockchain

- Internet of Things (IoT)

Using devices to monitor and collect data on the health of aircraft engines, LRUs, and other critical parts to analyze later for predictive maintenance.

With 84% of A&D executives considering Industry 4.0, the adoption of AM, AI, IoT, etc. will be among the aerospace and defense industry trends to follow.

4. Employing Blockchain Technology

The World Trade Organization (WTO) defines blockchain as “a tamper-proof, decentralized and distributed digital record of transactions that create trust and is said to be highly resilient.”

The adoption of blockchain technology is also part of Industry 4.0. By using blockchain’s distributed ledger technology (DLT), OEMs can potentially eliminate many risks involved in working with external upstream manufacturers.

These risks include:

- The possibility of copyright infringement. There is a risk of the partner exposing the OEM’s designs to another party. With DLT, the OEM can set-up an audit trail to see which parties are accessing its designs.

- The manufacturer misrepresenting its production or quality assurance capabilities. But the OEM could validate the manufacturer’s history (e.g., past work with other clients) if the manufacturer allows its machines to submit data to a ledger.

However, as it stands today, the A&D space is still only considering blockchain. If and when the industry implements blockchain, we will have a clearer idea of its use cases.

5. Implementing Lean Six Sigma in the Supply Chain

The objective of Lean Six Sigma is to eliminate waste in the manufacturing process by stripping out any activity or input that doesn’t add value for the customer. The intended outcome is to cut costs and, in turn, boost revenue by giving the customer exactly what they want.

Lockheed Martin, one of the world’s dominant defense companies, heavily relies on its upstream partners around the world to manufacture combat aircraft and helicopters. Since 60% of its total costs come from its supply chain, Lockheed Martin looked to optimize it as a means to cut costs.

As a result, Lockheed Martin started the ‘Pursuit of Excellence’ program to encourage partners to adopt Lean. Upstream businesses seeking workshare in Lockheed Martin must show a track record of success in eliminating waste and cutting costs and time-to-market.

Get More Workshare Contracts from OEMs by Mastering Lean

6. Using Simulation Modeling

Be it commercial airlines or military end-users, the downstream segment of the A&D sector is already making use of simulation modeling to achieve a range of outcomes.

Recently, the British Army was having trouble with maintaining its Apache attack helicopters. In response, its engineering branch was demanding more resources. But its aviation commanders disagreed and said that engineering had enough people.

To solve the issue, the British Army contracted AnyLogic to design an agent-based simulation to optimize existing resources while meeting the command’s availability needs.

Likewise, airlines can use data from IoT devices on their aircraft to improve their maintenance, repair, and overhaul (MRO) processes. They can use the data to set-up just-in-time orders for parts and schedule maintenance downtime outside of busy flight periods.

In effect, aircraft users can partly offset rising fuel costs by cutting costs in maintenance and logistics (e.g., storing fewer parts), but without affecting aircraft availability.

See How Simulation Modeling Helped

Production Outputs by $150 Million

Overall, OEMs will play a key role in shaping the look of the aerospace sector in the coming years. Whether you’re an OEM or an upstream/downstream partner, you will need insights about the near and long-term to make the right business decisions.

Slash costs, mitigate risks and accelerate your time-to-market by working with the modeling and simulation experts at MOSIMTEC. Contact us today.